The recent trajectory of US stocks has seen a sharp shift, transitioning from a relentless rally to a persistent pullback. After experiencing five consecutive winning months without a 2% decline, the market has faced three consecutive down weeks. This 5.5% setback in the S&P 500 is primarily attributed to the uncertainty surrounding Federal Reserve policy.

The theme of sticky inflation coupled with the cautious stance of the Fed has led to significant fluctuations in the 10-year Treasury yield, soaring from 4.2% to over 4.6% within just three weeks. The prospect of a potential rate cut by the Federal Reserve has been pushed further in traders' estimations.

This week, the focus shifts to the Personal Consumption Expenditures (PCE) report, which will gauge inflation against the Fed's target. This could trigger another shift in the market narrative towards a more hawkish stance, especially given the current assumptions of strong consumer resilience and higher oil prices.

From a trading perspective, the recent pullback has not only led to oversold conditions but has also helped to unwind aggressive market positioning and temper investor expectations, coinciding with a significant week of big-cap earnings reports.

Recent statements from multiple Fed officials advocate for a patient, data-driven approach, signalling that rate cuts soon are unlikely. Fed Chair Jerome Powell emphasised the slow progress in curbing inflation and stressed the need for policymakers to be more confident before considering easing measures.

However, there's a lingering concern about the potential scenario where inflation not only stagnates but also surges, driving up rate hike expectations. Echoing past policy mistakes, particularly those of the 1970s, is something the Powell Fed aims to avoid. Fed Governor Michelle Bowman is among the few who have hinted at the possibility of rate hikes if inflation progress stalls or reverses.

Despite these statements, the Fed's "dot plot" projection indicates no rate hikes expected by any of the 19 members, with only two anticipating no rate reductions this year. Fed funds futures markets reflect a similarly dovish sentiment, with minimal probability assigned to rate increases this year and a majority anticipating further cuts.

Nonetheless, the market has had to adapt its expectations significantly this year in response to unexpected inflation data, shifting from pricing in multiple rate cuts to now anticipating fewer cuts. Any persistent or re-emerging inflationary pressures could prompt further adjustments in market expectations, underscoring the significant risk of sticky inflation and uncertainty surrounding Fed policy to US stocks.

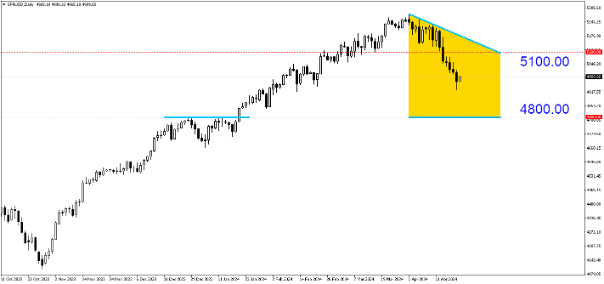

SPXUSD (Daily). Confirmation of a correction pattern after a 6-month rally. It could bring the S&P500 further down to its Support level of 4800.00.

Fullerton Markets Research Team

Your Committed Trading Partner

Will the US Indices Continue Its Bearish Momentum?">

Will the US Indices Continue Its Bearish Momentum?">