The Consumer Price Index report for December has exceeded expectations, reflecting a 0.3% increase in consumer prices for the month, pushing the annual rate to 3.4%. This outpaced economists' predictions of a 0.2% increase in December and a 3.2% year-over-year basis.

The core CPI, excluding volatile food and energy prices, aligned with expectations, indicating persistent yet easing inflation pressures. This unexpected rise in CPI has broader implications for the market, particularly in the context of interest rates and the Federal Reserve's monetary policy.

The data indicates that future interest rate cuts may take longer to happen. This insight is critical for investors anticipating a more accommodative monetary policy to counter inflationary pressures. The Federal Reserve's potential reluctance to cut interest rates promptly could introduce an element of uncertainty and potential market volatility.

High inflation, as shown by the CPI data, is generally viewed negatively by the market. The prospect of slower interest rate cuts from the Federal Reserve may disappoint investors anticipating a more aggressive approach to address inflationary pressures.

According to the CME FedWatch Tool, markets are currently estimating a 70% chance that the central bank will decrease interest rates at its March meeting. The unexpected rise in CPI challenges this expectation, creating a scenario where markets may need to adjust their projections.

The sentiment, which had been strong around the possibility of rate cuts occurring sooner rather than later, could face a reversal if the outcome disappoints. This could potentially lead to increased pressure on stocks in the latter days as investors recalibrate their expectations based on the evolving economic landscape.

Tesla's Challenging Outlook in 2024

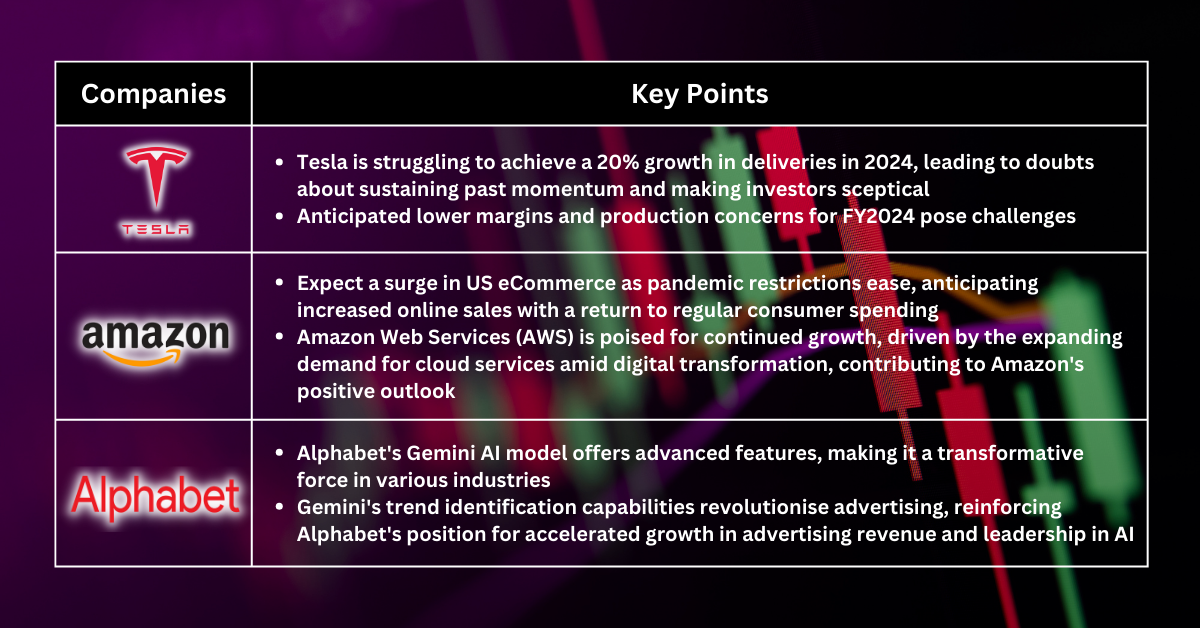

The outlook for Tesla in 2024 appears to be challenging, particularly concerning profitability. The anticipation of struggles to achieve a 20% growth in deliveries raises concerns about the company's ability to maintain its historical growth momentum. This potential shortfall in meeting ambitious growth targets may result in heightened scepticism among investors.

The expectation of lower margins and disappointing volumes for FY2024 adds a layer of uncertainty. It indicates potential difficulties in managing production costs, sustaining healthy profit margins, and achieving the anticipated sales levels. While ongoing cost-cutting measures may provide some relief, questions about the long-term sustainability of relying solely on this strategy loom large.

The remark regarding Tesla's limitation in lowering prices without risking negative free cash flow raises worries about the elasticity of demand. If price reductions do not result in a substantial increase in demand, it may affect the company's overall revenue and financial well-being.

The outlined challenges for Tesla in 2024 signal a period of uncertainty and potential headwinds. Investors will likely closely monitor how the company addresses these issues and whether Tesla can navigate these challenges to maintain its position in the highly competitive automotive industry.

Amazon's Potential Beneficiary Role in Easing Inflation

With the easing of pandemic-related restrictions and the fading of inflationary pressures, Amazon is poised to experience an acceleration in its US eCommerce business. As consumer spending returns to regular patterns and physical retail operations recover, Amazon's online sales are expected to experience heightened growth.

Amazon Web Services (AWS), the cloud computing arm of Amazon, is well-positioned for acceleration. The increasing demand for cloud services, especially in the wake of the digital transformation across industries, positions AWS for continued growth. Businesses and organisations adopting cloud solutions contribute to AWS seeing an uptick in revenue and market share.

The potential positives for Amazon revolve around the optimistic outlook for its eCommerce business in the US, the continued growth of AWS, an expected improvement in retail margins, and significant advertising opportunities within the Prime Video platform. These factors collectively contribute to a positive outlook for Amazon's future performance and financial success.

Alphabet's Potential Leadership in the AI Space

Gemini, Alphabet's latest and most powerful AI model, is designed to offer advanced capabilities for various applications. The model's versatility spans customer service engagement, trend identification for targeted advertising, content creation, and productivity applications. This flexibility positions Gemini as a transformative force across different industries.

Gemini's knack for identifying trends is emphasised as a revolutionary factor in the advertising industry. Advertisers can leverage insights generated by the model to tailor strategies in alignment with emerging trends and consumer preferences. This targeted approach is expected to lead to more effective advertising campaigns and increased return on investment for businesses.

The versatility of Gemini extends to content creation and productivity applications. It has the potential to assist in generating creative content, automating aspects of content production, and improving overall efficiency in productivity applications.

The launch of Gemini is deemed strategic, with far-reaching implications for Alphabet. Its versatility, combined with the strength of the U.S. consumer market, positions Alphabet for accelerated growth in advertising revenue and reinforces its leadership in the internet and AI space.

The developments around Gemini position Alphabet as a potential leader in the AI space, with a technology that has broad applications and significant implications for the future of artificial intelligence.

Fullerton Markets Research Team

Your Committed Trading Partner

Stocks Pick of The Week - US CPI Challenges Fed’s Rate Cut Outlook, What You Should Buy And Sell">

Stocks Pick of The Week - US CPI Challenges Fed’s Rate Cut Outlook, What You Should Buy And Sell">