Consensus widely expects Fed cuts and solid consumer spending to allow the U.S. economy to glide down for a soft landing. However, Fed Chairman Jerome Powell said Thursday that policymakers are encouraged by the slowing pace of inflation but are unsure whether they have done enough to keep the momentum going.

There is growing concern among some traders that November’s hot start has more to do with hedge funds racing to cover their bearish bets than an actual change in the stock market’s prospects.

Powell’s speech comes with inflation still well above the Fed’s long-standing goal but also considerably below its peak levels in the first half of 2022. In the 11 rate hikes that constituted the most aggressive policy tightening since the early 1980s, the committee took its benchmark rate from near zero to a target range of 5.25%-5.5%.

After Powell's speech, the 10-year U.S. Treasury yield jumped 11 basis points to 4.622% after the 30-year bond auction saw weak demand. The 2-year Treasury yield added roughly four basis points to 4.98%.

At the same time, Fed Governor Michelle Bowman said Thursday she still expects interest rates to rise. There is an unusually high level of uncertainty regarding the economy and my economic outlook, especially considering recent surprises in the data, data revisions, and ongoing geopolitical risks.

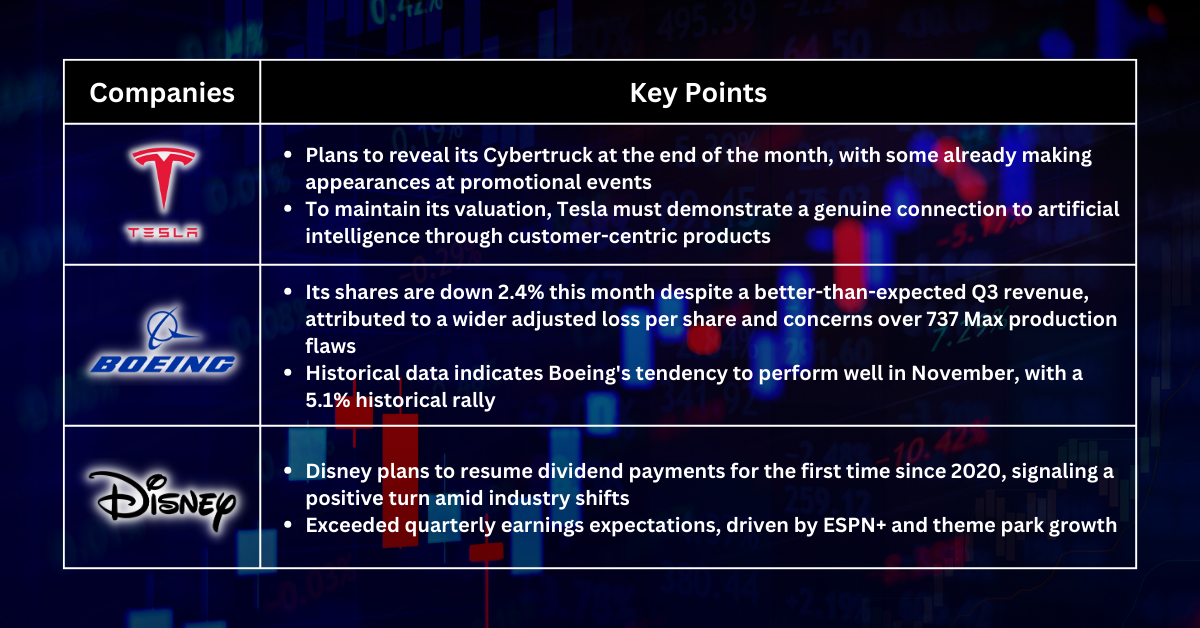

Tesla: No good news to attract buyers

Tesla is expected to host a Cybertruck event at the end of this month. While the specs and pricing for the final version of the Cybertruck have yet to be revealed, Tesla has allowed some Cybertrucks to be trotted around to promotional events.

However, significant delays or developments that show a lack of technological and regulatory feasibility for a commercial launch of tech projects pose a significant risk for Tesla.

Meanwhile, on Thursday, President Joe Biden spoke to UAW workers, where he voiced support for the union leader’s ambition to strike collective agreements with Tesla, Toyota and others. Tesla should use AI in products to enhance the customer experience and safeguard its valuation.

Boeing: Buy dip opportunities?

Shares of Boeing are down about 2.4% so far this month after the 737 Max maker reported better-than-expected third-quarter revenue but a wider-than-expected adjusted loss per share. The stock fell following news of production flaws affecting the 737 Max.

In the face of these challenges, historical data indicates a tendency for Boeing to exhibit strong performance in November. The stock has, in the past, rallied by 5.1% during this period. This historical trend may be attributed to various factors, such as seasonal market trends, industry dynamics, or specific events and announcements that historically occurred in November and positively impacted Boeing's stock.

Disney: More inflows expected as dividend payout resumes

After a hiatus since 2020, Disney intends to reinstate dividend payments to shareholders, marking a pivotal step in the media giant's turnaround amidst significant industry changes.

This week, Disney posted quarterly earnings that topped expectations thanks to profit at ESPN+ and continued growth at theme parks. The company plans to continue to “aggressively manage” its cost base, increasing its cost-cutting measures by an additional $2 billion to a target of $7.5 billion.

Fullerton Markets Research Team

Your Committed Trading Partner

Stocks Pick of The Week - Powell’s Warning On More Rate Hikes Suggests Consideration of Non-Tech Stocks For Now (Clone)">

Stocks Pick of The Week - Powell’s Warning On More Rate Hikes Suggests Consideration of Non-Tech Stocks For Now (Clone)">