The robust growth of the U.S. economy in the fourth quarter, exceeding expectations with a 3.3% expansion compared to the anticipated 2%, highlights a noteworthy resilience despite ongoing interest rate hikes. This positive deviation from economists' predictions underscores the underlying strength of the nation's economic fundamentals.

Moreover, the report presents encouraging developments in the realm of inflation. The price index for personal consumption expenditures, a key metric in assessing inflation, increased by 2.7% on an annualised basis. Importantly, this represents a significant decline from the 5.9% recorded in the preceding year.

The core PCE, which excludes the volatile elements of food and energy, also displayed a notable decrease, rising by 3.2% compared to the previous 5.1%. These figures suggest a moderation in inflationary pressures, relieving consumers who have been grappling with the impact of rising prices.

The observation that consumers are recovering from the painful shock of inflation aligns with the broader economic narrative. These positive reports indicate both an economic rebound and the improved sentiment seen in December, suggesting that Americans are starting to reap benefits from tight monetary policies, bolstering economic recovery and stability.

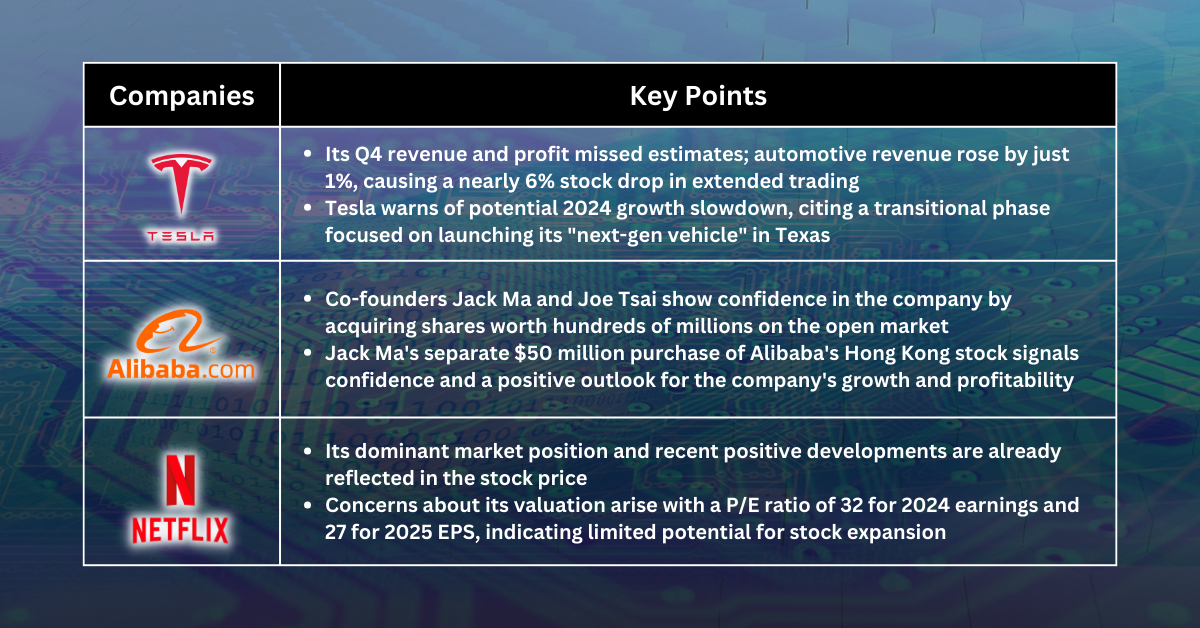

Tesla: Earnings missed estimates with darker outlook

Tesla reported revenue and profit for the fourth quarter that missed analysts’ estimates as automotive revenue increased just 1% from a year earlier. The stock slid almost 6% in extended trading.

Tesla said in its investor presentation that vehicle volume growth in 2024 may be notably lower than last year’s growth rate as the company works toward launching its “next-generation vehicle” in Texas. The company cautioned investors that it’s “currently between two major growth waves.”

Alibaba: Follow what the bosses are doing

Alibaba co-founders Jack Ma and Joe Tsai have acquired shares worth hundreds of millions of dollars on the open market.

Separately, sources familiar with the matter told the Times that Ma acquired $50 million worth of Alibaba’s Hong Kong stock during the same period. Depositary shares are effectively U.S.-traded versions of foreign stock.

When insiders, especially high-profile figures like co-founders, purchase shares on the open market, it is often interpreted as a positive signal. The purchase of shares indicates that Jack Ma and Joe Tsai have confidence in Alibaba's future performance. They believe that the current stock price undervalues the company's true worth.

Insiders usually have access to more information about the company's internal workings and plans. Their decision to invest in the company may be based on a positive outlook for Alibaba's growth and profitability.

Netflix: Many good things have been priced in

We think that Netflix's dominant market position and recent positive developments have already been factored into the stock price, especially following its remarkable 65% growth in 2023.

The critical consideration revolves around Netflix's valuation. With a price-to-earnings ratio of 32 for estimated 2024 earnings per share and 27 for 2025 EPS, it implies that there may be limited potential for additional multiple expansion in the stock. This caution is underscored by the expectation of peak EPS growth in 2024, projected at 38%, with a subsequent deceleration to 21% and 16% in 2025 and 2026, respectively.

We acknowledge the possibility that his estimates could prove conservative, but we do not foresee significant upward revisions for 2024 comparable to those seen in October 2022.

At that time, the market was sceptical about the success of paid sharing, and the subsequent positive developments led to a more bullish stance. However, the current assessment suggests a more tempered outlook for Netflix's near-term growth potential.

Fullerton Markets Research Team

Your Committed Trading Partner

Stocks Pick of The Week - Macro Condition Is Positive, But Some Tech Stocks Are Just Too Expensive">

Stocks Pick of The Week - Macro Condition Is Positive, But Some Tech Stocks Are Just Too Expensive">