Currently, the stock market is riding high with investors pouring money into fast-growing companies. However, this euphoria may be masking significant risks that could trigger a major downturn. Despite the market's exuberance, there are looming concerns, particularly regarding politics and inflation, that are being overlooked. These overlooked factors have the potential to push interest rates higher, leading to a correction in stock prices.

One of the major risks being downplayed by investors is the upcoming election. While the ongoing political drama between Biden and Trump hasn't significantly impacted the market, it's crucial to note that political uncertainty can have profound effects. Even a subtle indication from the Federal Reserve can trigger significant market fluctuations, but as of late, attention has shifted away from monetary policy towards political developments. The prevailing sentiment suggests a belief in a stable and somewhat cautious central bank, which is alleviating concerns among investors. However, this complacency towards political risks could be a mistake.

The upcoming election holds immense importance, not just for the nation's leadership but also for economic policy. The individual elected will have the responsibility of appointing the next Federal Reserve chair, a decision that will shape the trajectory of monetary policy for years to come. Yet, amidst the fervour of market activity, investors seem to be overlooking the potential impact of this critical decision.

It's imperative for investors to consider how different election outcomes could influence market dynamics, particularly within sectors such as industrial and technology stocks. Additionally, global investors are closely monitoring how international relations could affect both foreign and domestic markets. However, despite the significance of these factors, there appears to be a lack of attention towards their potential ramifications.

Historical data provides valuable insights into the relationship between market performance and election outcomes. Analysis indicates that in 20 out of 24 past elections, a rising stock market three months before Election Day has favoured the incumbent, while a declining market has often benefited the challenger. Therefore, the market's movements leading up to the election could play a pivotal role in determining its outcome.

Stick with Nvidia

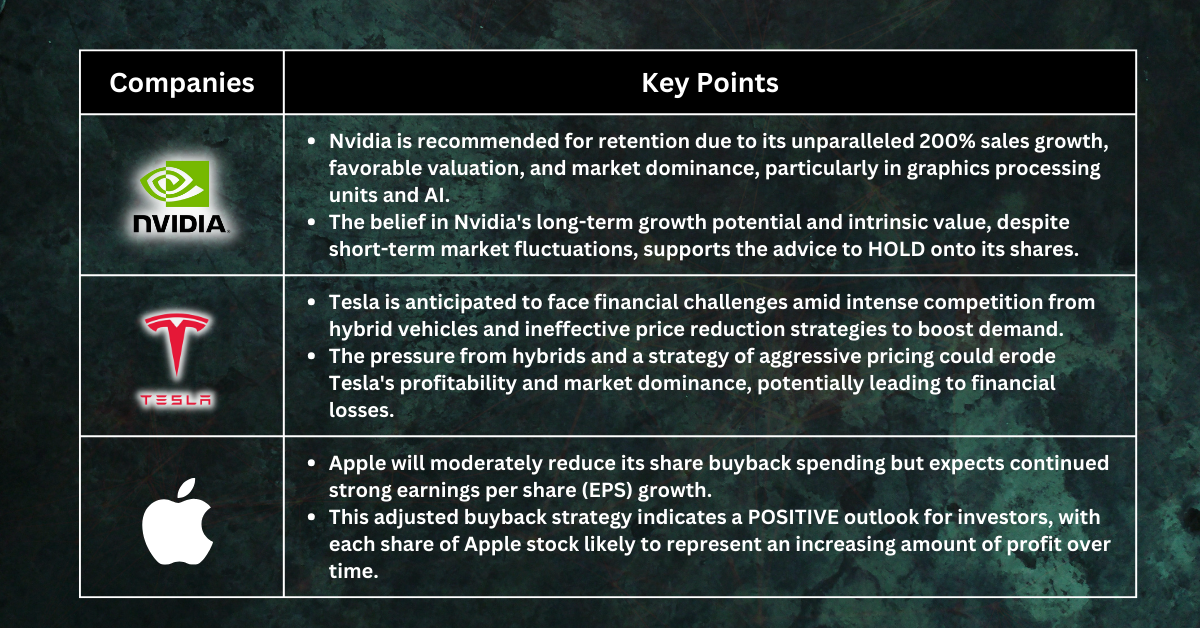

We maintain a steadfast conviction that divesting from Nvidia shares at this juncture would be premature. Our rationale stems from a distinct lack of alternatives boasting the remarkable 200% sales growth exhibited by Nvidia. When juxtaposed against its current valuation of approximately 26 times forecasted earnings and its entrenched monopoly in the market, the case for retaining Nvidia shares becomes even more compelling.

Despite a temporary downturn in Nvidia's stock price, our confidence in its long-term prospects remains unwavering. We contend that Nvidia remains attractively priced, particularly when one takes into account its anticipated earnings trajectory and its unparalleled dominance in the graphics processing units sector, particularly within the realm of artificial intelligence.

In essence, our stance underscores a belief that Nvidia's intrinsic value transcends short-term fluctuations and is anchored in its fundamental strengths and market positioning. Thus, we advocate for a steadfast approach, retaining faith in Nvidia's ability to deliver sustained growth and value creation over the foreseeable future.

Tesla: Financial loses look real

Tesla faces a looming challenge in the upcoming quarters as it grapples with the possibility of financial losses. Despite implementing price reductions in a bid to stimulate demand for its electric vehicles, Tesla's efforts have thus far proven ineffective against the backdrop of formidable competition from hybrid cars.

The automotive landscape has become increasingly competitive, with traditional automakers aggressively entering the electric vehicle market with their own hybrid offerings. This intensified competition has created headwinds for Tesla, as consumers now have a wider array of options to choose from, diluting the exclusivity and allure that once characterized Tesla's brand.

Despite Tesla's reputation for innovation and cutting-edge technology, the allure of hybrid vehicles, which offer the convenience of traditional gasoline engines coupled with the environmental benefits of electric power, has posed a formidable challenge to Tesla's market dominance. Consumers are increasingly drawn to hybrid models that offer a seamless transition to electric power while alleviating concerns about range anxiety and charging infrastructure.

Furthermore, Tesla's aggressive pricing strategy, aimed at stimulating demand and maintaining market share, may have inadvertently eroded profitability. The sustained pressure to reduce prices to remain competitive in the face of hybrid alternatives has squeezed Tesla's margins, potentially leading to financial losses in the coming quarters.

Apple: No rush but buy dips

Overall, we still believe that Apple's strategy of buying back its own shares will remain a significant factor in how it manages its finances. However, we anticipate that the amount of money it spends on buybacks each year will decrease by about 200 basis points over the next 5 to 10 years compared to what it has been doing before.

Despite this decrease in buybacks, we predict that Apple's earnings per share (EPS), which is a measure of how much profit each share of Apple stock represents, will continue to grow at a strong rate, likely in the high single digits.

In simpler terms, Apple will still be using its profits to buy back its own shares, but it won't be doing it as aggressively as it has in the past. However, even with this reduction in buybacks, we expect that Apple's EPS will keep growing at a healthy pace. This means that each share of Apple stock will likely represent more profit over time, which could be good news for investors.

Fullerton Markets Research Team

Your Committed Trading Partner

Stocks Pick of The Week - Election Risk Overlooked By Traders May Force Market To Move Lower">

Stocks Pick of The Week - Election Risk Overlooked By Traders May Force Market To Move Lower">