Global central banks from the Fed to PBOC signal that the monetary policy this year will become easier this year, potentially opening doors for stocks to further gain.

Federal Reserve Chair Jerome Powell on Thursday indicated that interest rate cuts may not be too far off if inflation signals cooperate.

In remarks to the Senate Banking Committee, the central bank leader didn’t provide a precise timetable of when he sees easing happening, but noted that the day could be coming soon.

“We’re waiting to become more confident that inflation is moving sustainably at 2%. When we do get that confidence, and we’re not far from it, it’ll be appropriate to begin to dial back the level of restriction,” Powell said in response to a question about rates and inflation. He said the cuts would be so the Fed doesn’t “drive the economy into recession rather than normalizing policy as the economy gets back to normal.”

After his comments, stocks rose Thursday, pushing the S&P 500 and Nasdaq Composite back to record highs, as hope over easing inflation and gains in tech aided Wall Street’s midweek bounce.

Investor optimism was boosted after the European Central Bank lowered forecasts for annual inflation and growth on Thursday, though the bank also held key interest rates steady. That can be taken as a positive signal on the international inflation front.

In China, the heads of China’s central bank and economic planning agency signaled that authorities would be willing to take further steps to support growth, but did not announce any large-scale stimulus plans.

Pan Gongsheng, governor of the People’s Bank of China, said this week there was room to further cut banks’ reserve requirements. He also pledged to utilize monetary policy to “mildly” prop up consumer prices.

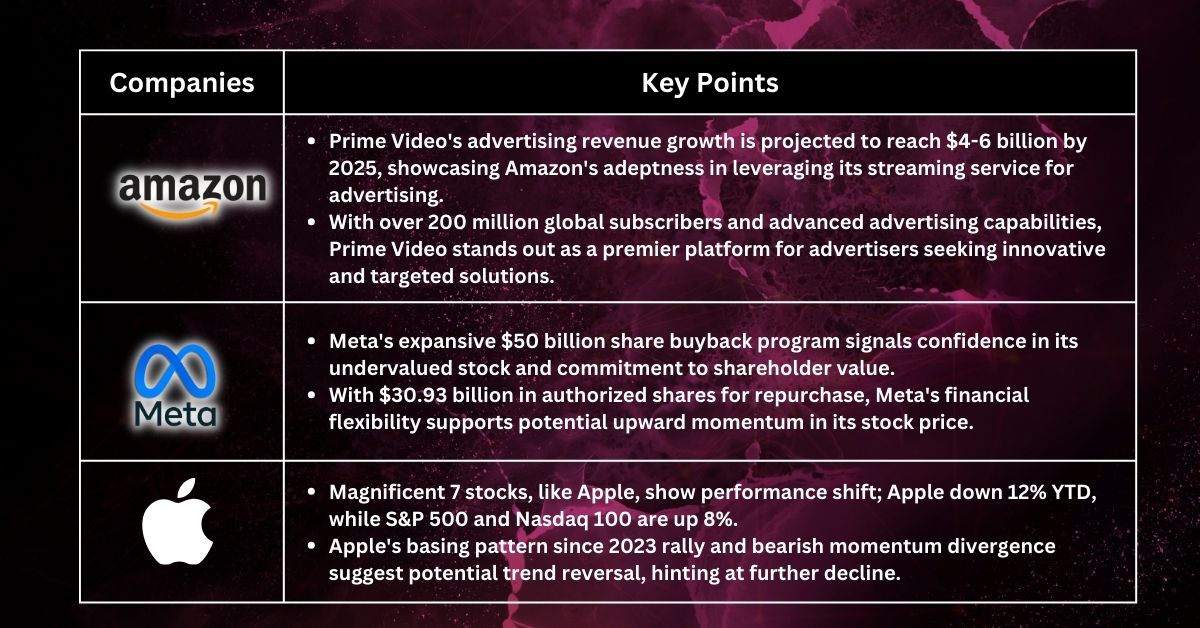

Amazon: More revenues from Prime Video platform

Amazon's Prime Video platform has become a significant player in the streaming landscape, not only for its vast array of content but also for its burgeoning advertising opportunities. With projections suggesting that Prime Video could generate $4 billion in advertising revenue in 2024 and potentially reach $6 billion by 2025, it's clear that Amazon is capitalizing on the advertising potential of its streaming service.

The rise of streaming services has transformed the way consumers engage with content, providing advertisers with new avenues to reach their target audiences. Amazon, with its vast ecosystem of services and products, including Prime Video, has been quick to recognize and leverage this trend.

One of the key factors driving Prime Video's advertising revenue growth is its massive and highly engaged user base. Amazon Prime, which offers access to Prime Video along with a host of other benefits, boasts over 200 million subscribers worldwide as of early 2024. These subscribers represent a captive audience that spends significant time on the platform, providing advertisers with ample opportunities to connect with consumers.

Moreover, Prime Video's advertising capabilities have evolved significantly in recent years, offering advertisers a range of innovative and targeted advertising solutions. From traditional video ads to interactive product placements and sponsored content, advertisers have numerous options to engage with viewers in meaningful ways. Additionally, Amazon's rich trove of customer data enables advertisers to target their campaigns with precision, ensuring that messages reach the right audience at the right time.

As streaming continues to gain traction globally and consumer habits evolve, the demand for targeted and measurable advertising solutions is expected to grow. With its robust infrastructure, vast audience reach, and innovative approach to advertising, Amazon is well-positioned to capitalize on this trend and further solidify Prime Video's role as a leading advertising platform in the streaming space.

Meta: Strong commitment to shareholders

Meta has shown significant commitment to its shareholders through its expansive share buyback program. With the recent expansion of its buyback program by $50 billion, Meta is demonstrating confidence in its own future and a willingness to invest in its own stock.

The decision to increase the buyback program suggests that Meta's management believes the company's stock is undervalued and that investing in it is a prudent use of capital. By repurchasing shares, Meta reduces the number of outstanding shares in the market, which can help to support and potentially increase the stock price over time. Additionally, buybacks can signal to investors that the company is financially healthy and committed to returning value to shareholders.

Furthermore, as of December 31, 2023, Meta had $30.93 billion of authorized shares available for repurchase, indicating a significant capacity for further buybacks in the future. This financial flexibility provides Meta with the opportunity to continue supporting its stock price through repurchases, which could contribute to upward momentum in the company's share price.

The expansion of Meta's share buyback program, coupled with its substantial available funds for repurchase, suggests a bullish outlook for the company's stock. Investors may interpret these actions as a positive signal of Meta's confidence in its future growth prospects, potentially driving the stock price higher in the coming periods.

Apple: Lagging behind

The performance of the once-dominant Magnificent 7 stocks has certainly shifted in the first quarter, with charts like Apple beginning to diverge from the rest of the mega-cap growth leadership names.

Apple is down just over 12% year-to-date, compared to the S&P 500 and Nasdaq 100, which are both up over 8% for the year. But is the recent decline for AAPL just the beginning?

Since a strong rally in the first half of 2023, Apple has essentially been in a basing pattern. The stock has ranged between resistance around $197 and support in the $165-170 range.

It's notable how the price peaks in July 2023 and December 2023 were marked by a decline in Relative Strength Index (RSI), forming the classic "bearish momentum divergence" pattern of stronger prices on weaker momentum. This divergence suggests that despite the price continuing to rise, the underlying strength of the stock was diminishing, which often precedes a reversal in price direction.

This pattern could signal a potential trend reversal for Apple, indicating that the recent decline may indeed be the beginning of a larger downward movement.

Fullerton Markets Research Team

Your Committed Trading Partner

Stocks Pick of The Week - Don't Wait To Buy Stocks As Global Central Banks Easing Mode Is Coming">

Stocks Pick of The Week - Don't Wait To Buy Stocks As Global Central Banks Easing Mode Is Coming">