IMPORTANT NOTICE!

In accordance with our policies, we do not provide services to individuals who are residents or legal entities based in Singapore.

You may acknowledge and continue browsing.

Stocks Pick of The Week - Navigating Rising Interest Rates: Strategies for Maximizing Profit

- October 16, 2023

- | Fullerton Research

As investors navigate an increasingly turbulent market landscape, the geopolitical complexities arising from the Israel-Hamas conflict are compounding the existing uncertainties linked to surging...

Middle East Conflict Sparks Over 4% Surge in Oil Prices

- October 9, 2023

- | Fullerton Markets

The eruption of hostilities between Israel and Palestine over the weekend has cast another layer of complexity for stock traders already grappling with a challenging market. However, the oil market...

Stocks Pick of The Week - Bond Market Becomes Stock’s Nightmare, Here Is The Smart Way To Trade

- October 9, 2023

- | Fullerton Research

The VIX index rose above 19 as stocks fell despite jobless claims remaining historically low. Fed’s rate outlook jitters stock traders now. The good news is that traders can profit from the market’s...

Stock Market Retreats, Economic Growth Slows: Rationale Behind FX Traders' Dollar Acquisition

- October 2, 2023

- | Fullerton Markets

Amidst the contemporary financial landscape, investors are grappling with a novel reality marked by the spectre of prolonged higher interest rates. Within this unfolding paradigm, the US dollar...

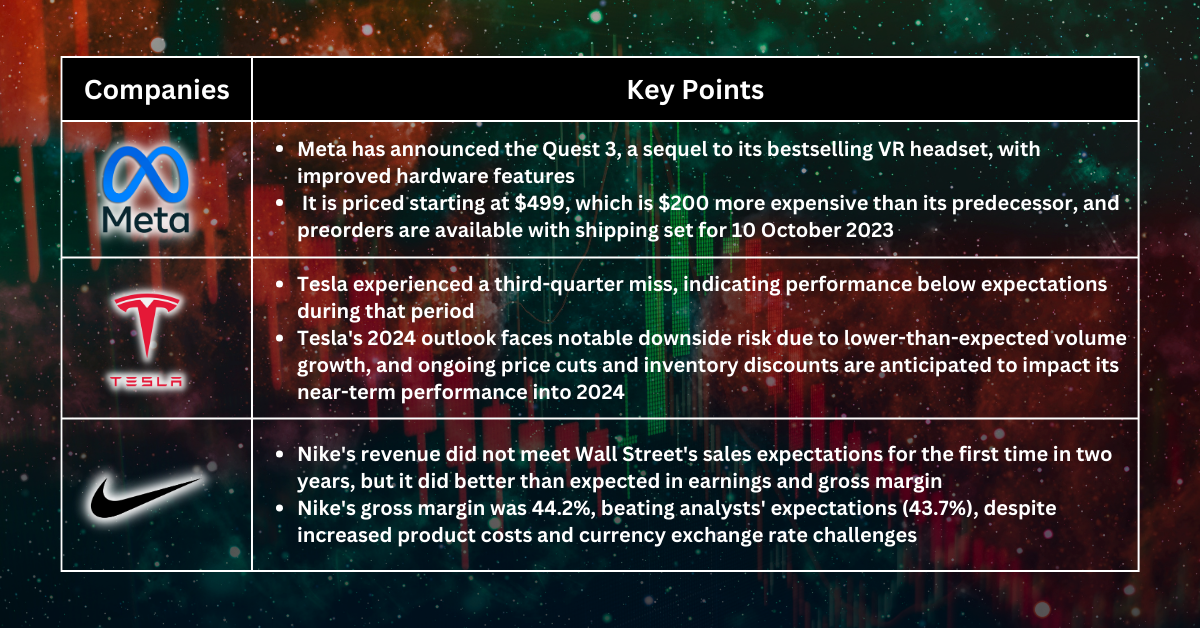

Stocks Pick of The Week - Market Mayhem: Nasdaq's Worst Month, Tesla's Troubles, and Nike's China Conundrum

- October 2, 2023

- | Fullerton Research

The Nasdaq Composite is off nearly 6% in September and down 4.3% for the quarter. This month will be the worst in 2023 for it. The Dow is on track for a 3% decline this month and a 2.2% fall for the...

Navigating Profit Opportunities Amidst Looming US Government Shutdown

- September 25, 2023

- | Fullerton Markets

The eyes of traders remain vigilantly fixed on the unfolding budget resolution drama in the heart of Washington. As the weekend waned, lawmakers exhibited scant signs of progress toward a deal that...

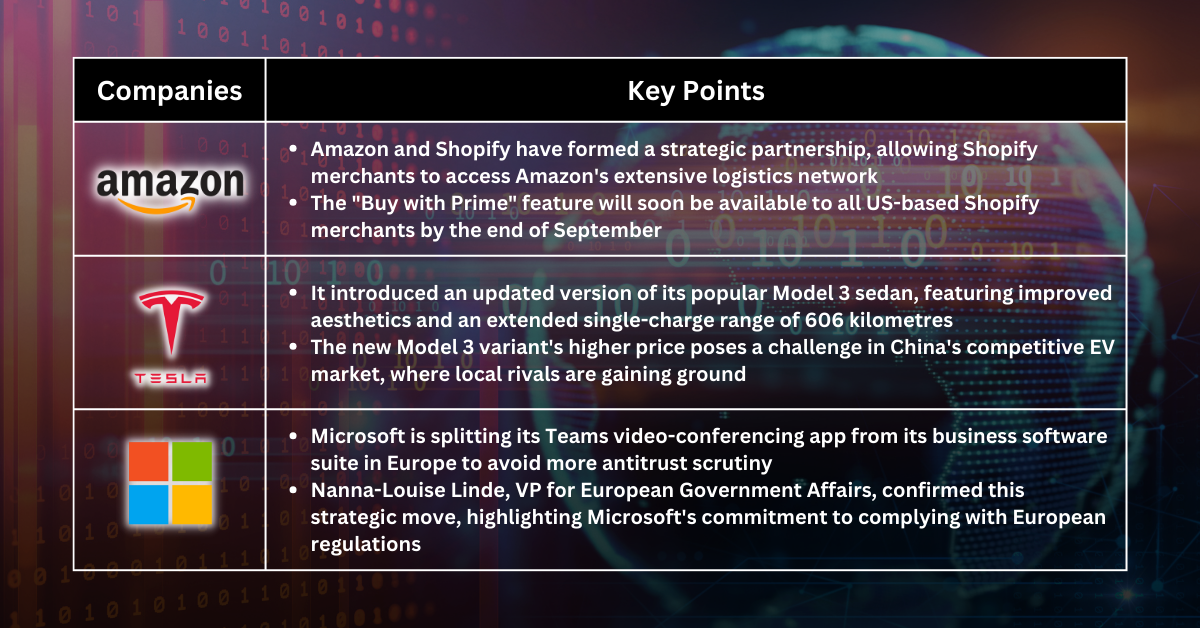

Stocks Pick of The Week - Riding the Short-Selling Wave Amid Market Uncertainty

- September 25, 2023

- | Fullerton Research

Concerned about recent market downturns or the possibility of a recession? Here's some good news: The Federal Reserve's recent signal that interest rates won't drop as steeply as expected might have...

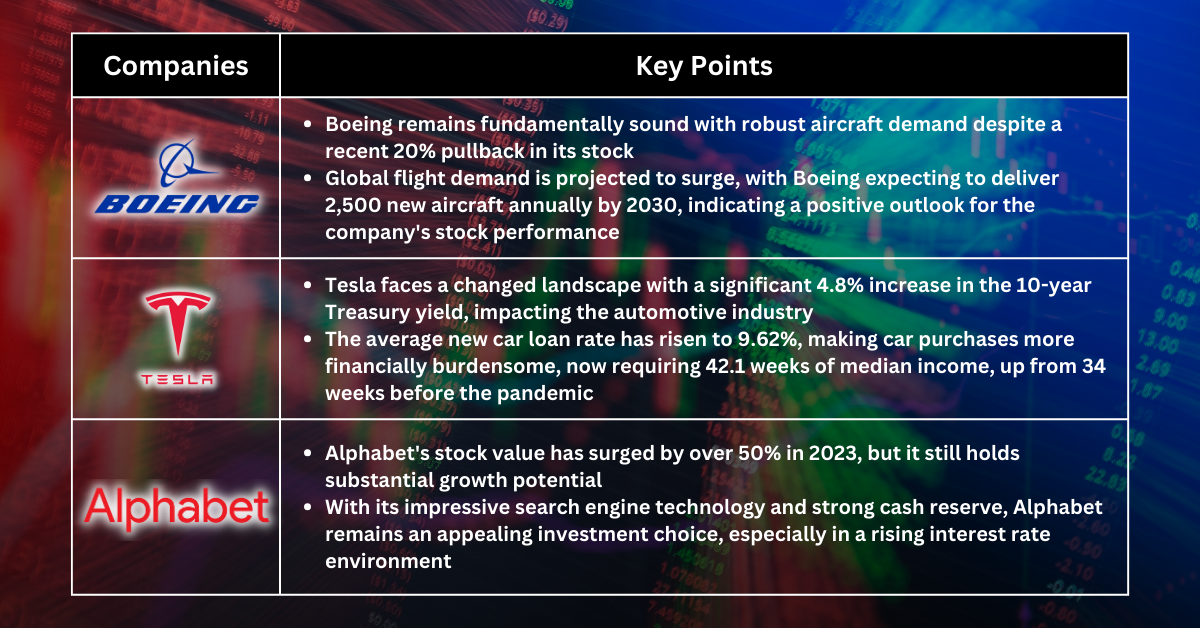

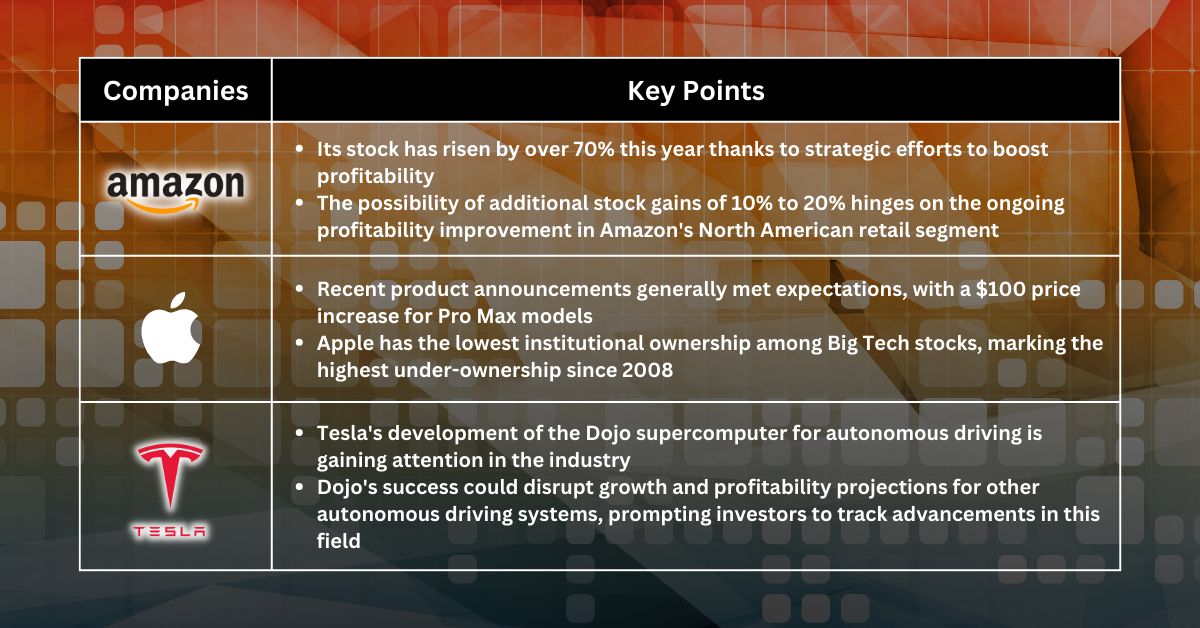

Stocks Pick of The Week - Tech Investors Eye Opportunities Amid Fed's Hike Hints and Inflation Surprises

- September 18, 2023

- | Fullerton Research

The producer price index for August outpaced expectations, surging by 0.7%, exceeding the anticipated 0.4% increase. However, the core producer price index (PPI) is aligned with the projected 0.2%...

Nasdaq Index Plummets Amidst Rising Oil Prices: A Fed Interest Rate Dilemma

- September 18, 2023

- | Fullerton Markets

In a tumultuous market scenario, the Nasdaq index witnessed a sharp sell-off, drawing significant attention to the interplay between the Federal Reserve's interest rate policies and the surging oil...

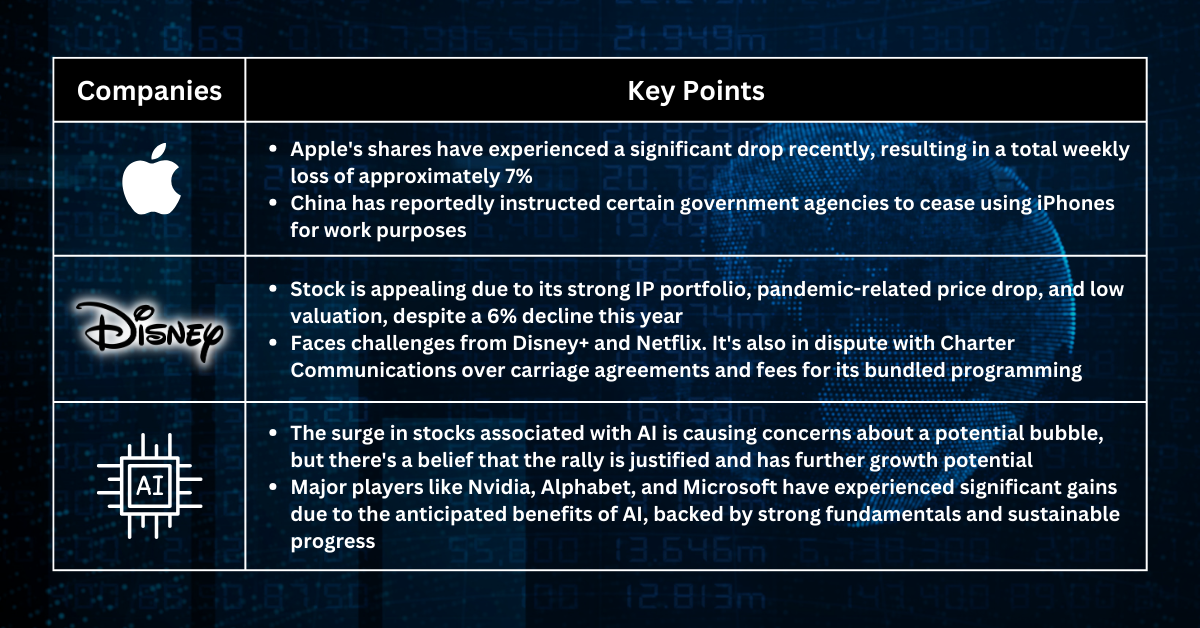

Stocks Pick of The Week - Fed’s Policy Uncertainty Weighs on Tech as Inflation Fears Return

- September 11, 2023

- | Fullerton Research

The drop in US stocks in recent days as renewed concern swirled on Wall Street over the Fed’s interest rate policy path and whether policymakers will enact another hike this year.

Market Anticipation Grows: Analysing the Upcoming US CPI Data Release and Its Implications

- September 11, 2023

- | Fullerton Markets

As the August consumer price index (CPI) prepares for its midweek release, investors eagerly await this pivotal economic indicator. This report carries significant weight as it represents the final...

US Jobs Report Says Fed Will Hold This Month, Will That Help Stocks?

- September 4, 2023

- | Fullerton Markets

Data last week showed that hiring cooled over the summer and that economic growth and price pressures remained modest, supporting the case for the Fed leaving interest rates unchanged from their...

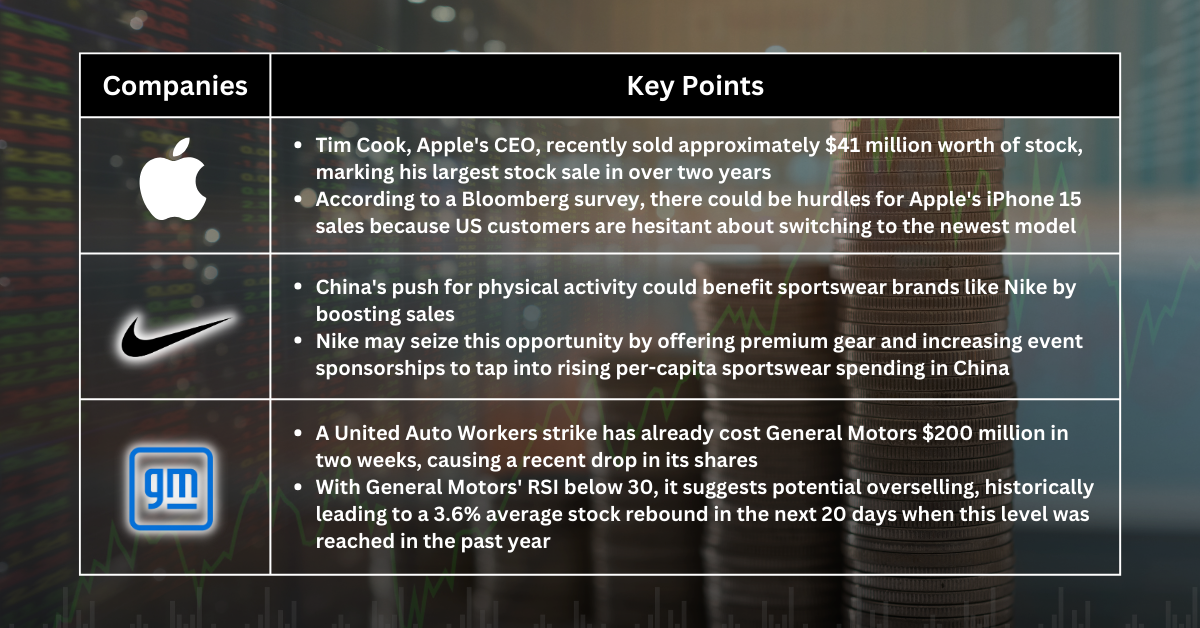

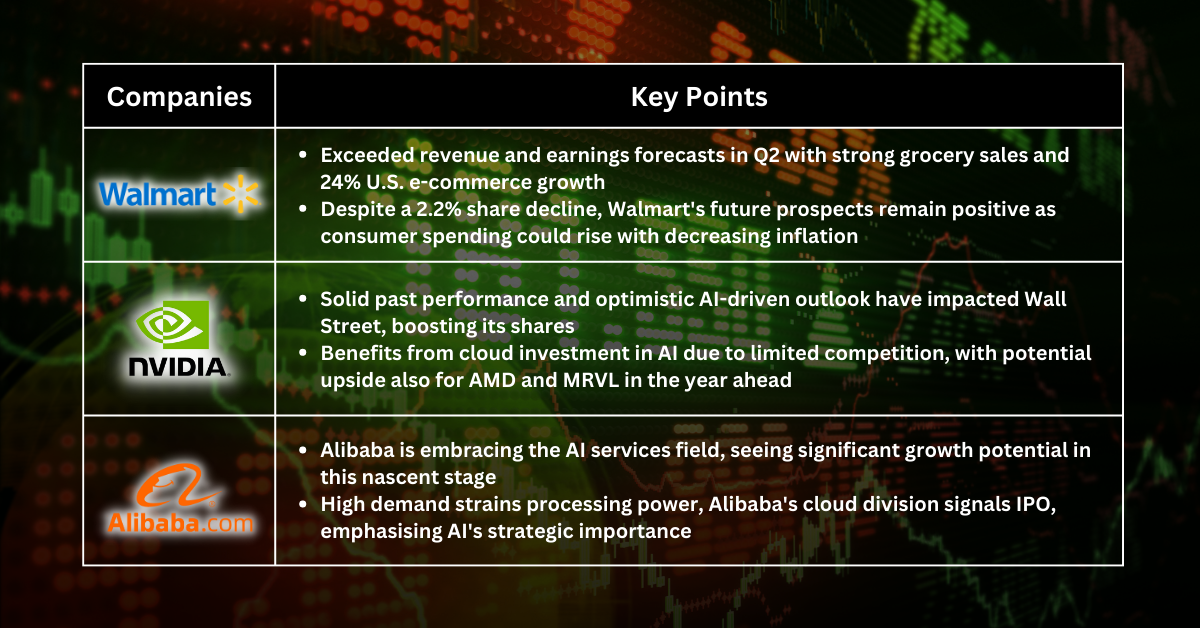

Stocks Pick of The Week - Stock Market Faces Murky September Outlook Amid Heightened Uncertainties

- September 4, 2023

- | Fullerton Research

Following a tumultuous August, investors brace themselves for what history deems a stormy September. As the financial landscape continues shifting, a constellation of factors demands investor...

US Labour Market Report Looms: A Crucial Factor in Fed's Interest Rate Decision

- August 28, 2023

- | Fullerton Markets

As long-term US government bond yields experience a recent surge and global growth trends waver, the impending US jobs report holds the potential to tip the scales for the Federal Reserve's upcoming...

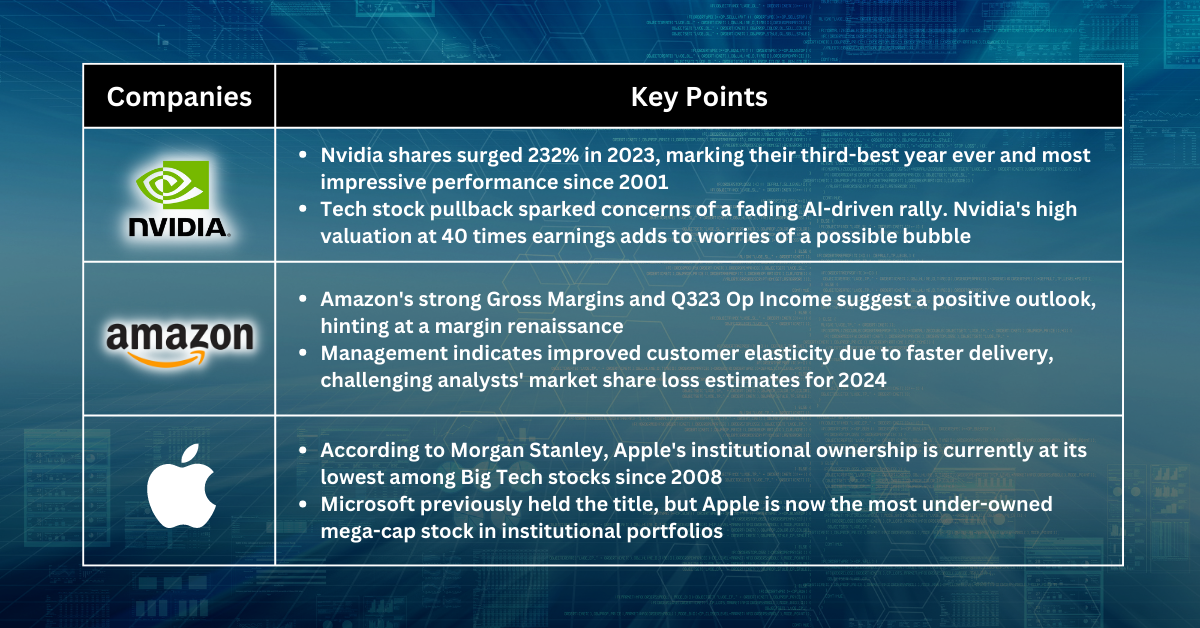

Stocks Pick of The Week - Profit Taking on Nvidia Before Jackson Hole Shows Wall Street Turns Cautious Now

- August 28, 2023

- | Fullerton Research

Nvidia gained just 0.1% after its 3.2% rise the prior day. The graphics chip maker at the heart of the artificial intelligence boom reported record sales that doubled from a year ago. Nvidia looked...

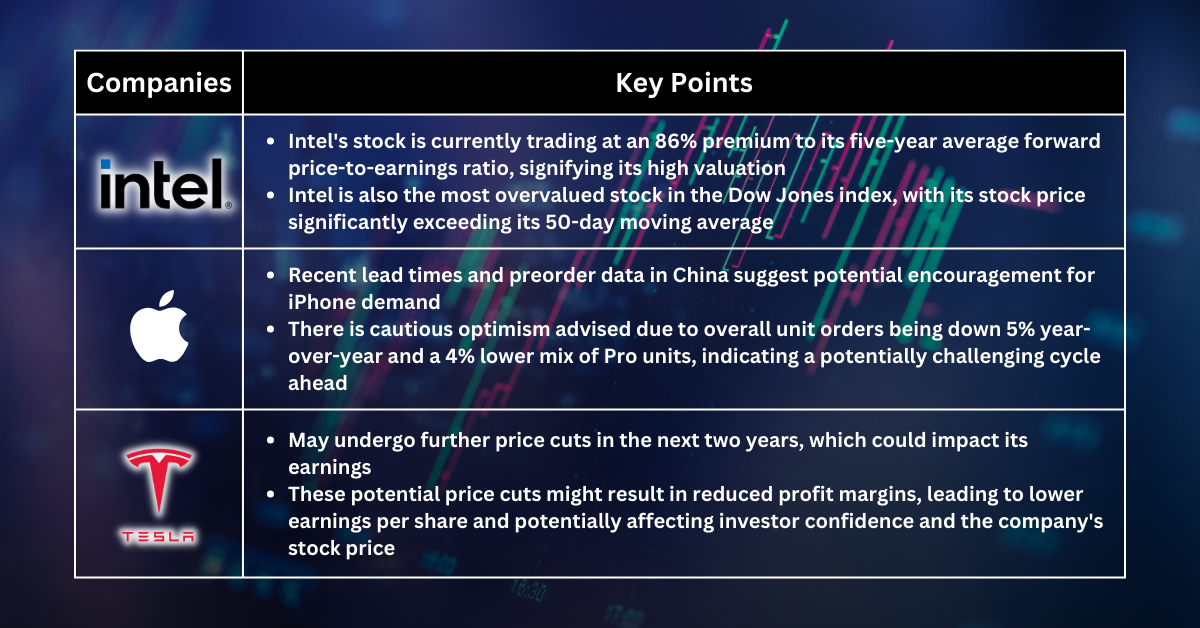

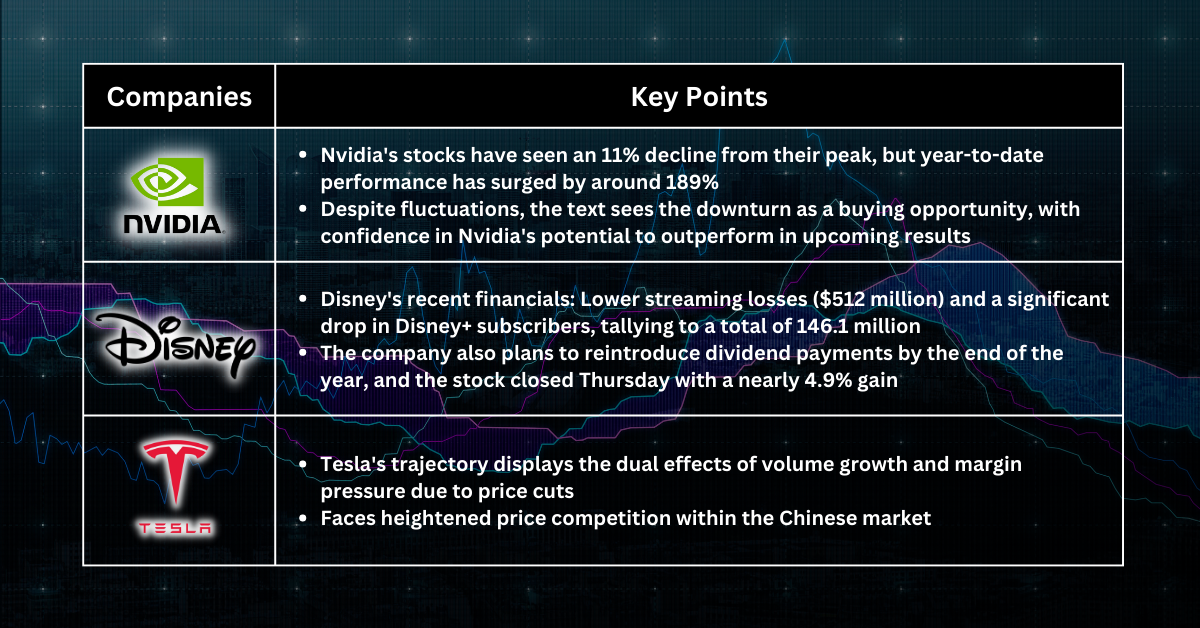

Stocks Pick of The Week - Market Volatility Amid Fed's Continued Tightening, Yet Lucrative Prospects Await

- August 21, 2023

- | Fullerton Research

August has ushered in market turbulence, with important indices poised for another week of losses, veering into negative territory for the month. The exuberant rally witnessed in the last half of the...

Stocks Pick of The Week - Inflation Data Alters Fed Expectations; Tech Sector Reacts

- August 14, 2023

- | Fullerton Research

The market has seemingly reached a verdict: July's subdued inflation report has led to an anticipation of the Federal Reserve refraining from further interest rate hikes.

Exercising Caution Amidst Positive Headlines: Unveiling Deeper Layers

- August 14, 2023

- | Fullerton Markets

At a cursory glance, the current landscape appears overwhelmingly optimistic. The Federal Reserve's near culmination of its interest rate hiking cycle, decelerating inflation, and earnings surpassing...

Upcoming US CPI Data Looms as Pivotal in Deciding Hiking Cycle's Fate

- August 7, 2023

- | Fullerton Markets

Market participants anticipate an impending boost in market sentiment as a new set of inflation data is poised for release in the forthcoming week, with the Consumer Price Index (CPI) data scheduled...