IMPORTANT NOTICE!

In accordance with our policies, we do not provide services to individuals who are residents or legal entities based in Singapore.

You may acknowledge and continue browsing.

Stocks Pick of The Week - Be Mindful of Potential Sell-Off As Market Is Too Expensive Now

- December 26, 2023

- | Fullerton Research

Wall Street is anticipating a "Santa Claus Rally" during the final trading days of the year and the first two days of the new year. Historically, the S&P 500 has shown an average gain of 1.3% since...

Market Bull Run May Pause as Fed’s Powell May Make a Big Mistake (Clone)

- December 18, 2023

- | Fullerton Markets

The prevailing market optimism surrounding potential interest rate cuts in the upcoming year has reached a level that warrants caution.

Stocks Pick of The Week - Tech Stocks Surge as Fed Signals Three Rate Cuts in 2024

- December 18, 2023

- | Fullerton Research

Investor confidence is on the rise as prospects of additional rate cuts in 2024 emerge, propelling equity indices to record highs and causing Treasury yields to dip.

FOMC Meeting Looms Large Following Strong NFP Performance

- December 11, 2023

- | Fullerton Markets

The recent employment report, surpassing expectations, showcased a resilient economy with a seasonal addition of 199,000 jobs in the past month. This boost, partly attributed to the resolution of...

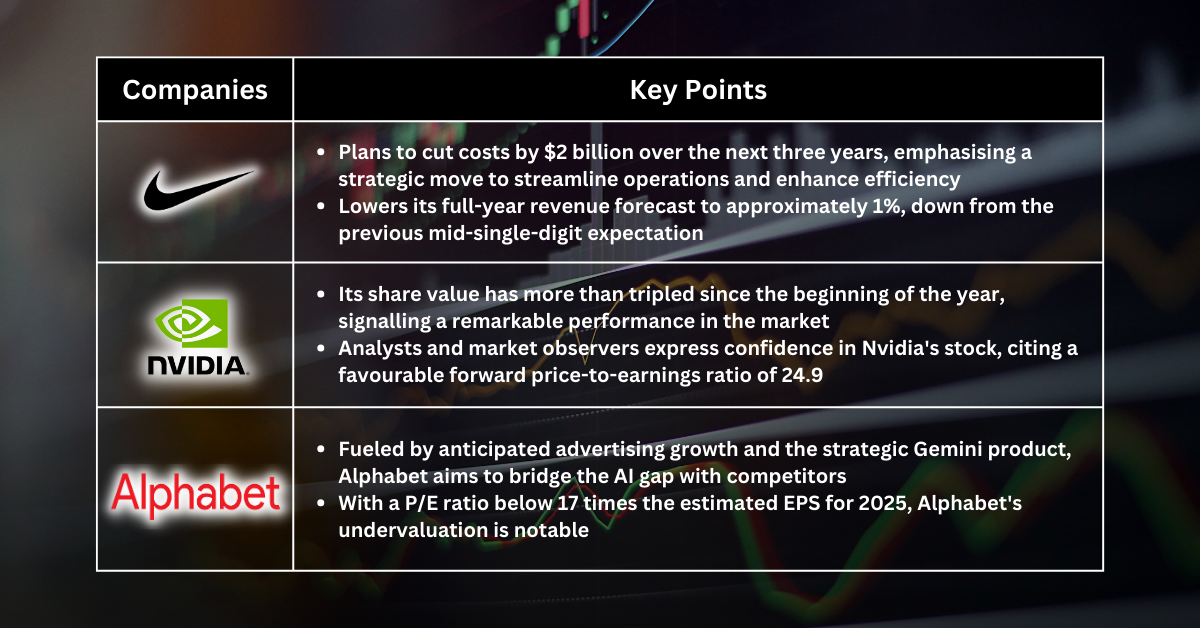

Stocks Pick of The Week - Survey Shows Stock Sentiment Weakening, But AI Race Could Be The Opportunity

- December 11, 2023

- | Fullerton Research

Investors have been focused on jobs data as initial jobless claims reported on Thursday were 220,000 while continuing claims came in at 1.861 million.

Gold Prices Surpass $2,100, Signaling Prolonged Upside in 2024

- December 4, 2023

- | Fullerton Markets

The recent surge in gold prices, reaching an impressive $2,100 per ounce on Monday for the second consecutive day, has become a focal point for investors, hinting at a potential trend that might...

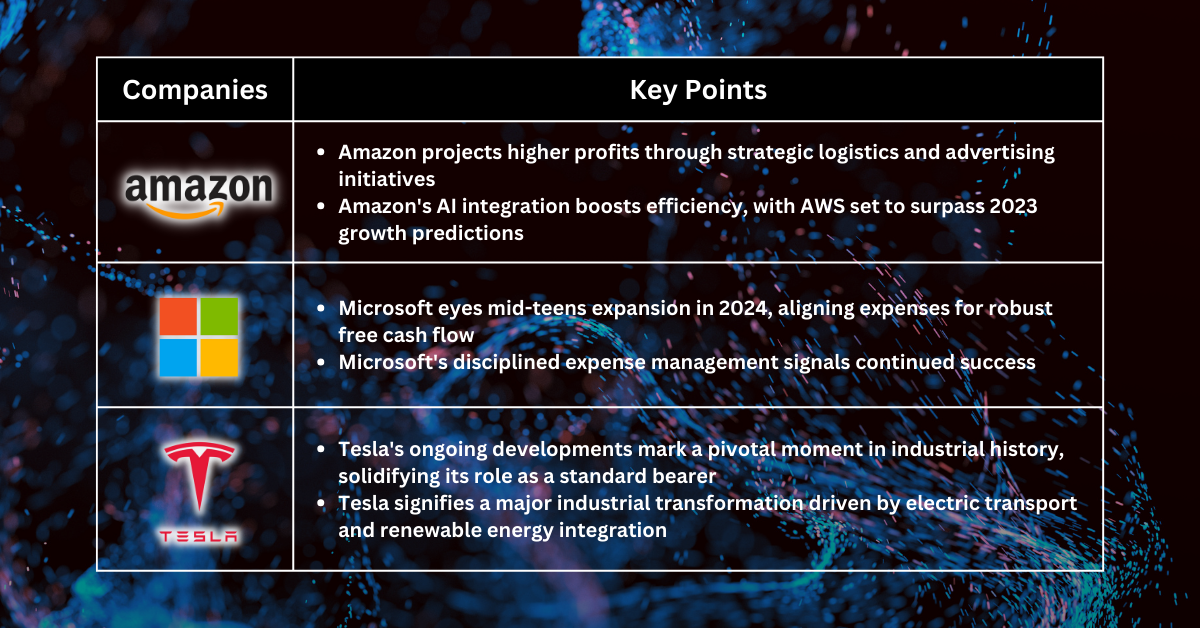

Stocks Pick of The Week - Stock Momentum Persists Amid Overwhelming Expectations for Fed Rate Cut

- December 4, 2023

- | Fullerton Research

Investors remain optimistic that the Fed has wrapped up its rate-hiking regime and that the economy is on track for a soft landing.

Historic Trends Support Ongoing Stock Rally, Indicating Upside Potential (Clone)

- November 27, 2023

- | Fullerton Markets

As November draws to a close, Wall Street is set to wrap up the month on a robust note, with stock indices eyeing new highs as the year concludes.

Stocks Pick of The Week - Buy, Buy, Buy! Falling Bond Yield Drives Tech Stocks Crazy

- November 27, 2023

- | Fullerton Research

The S&P500 index has climbed 8.7% in November so far, on track for its strongest monthly showing since July 2022. It is up 19% in 2023.

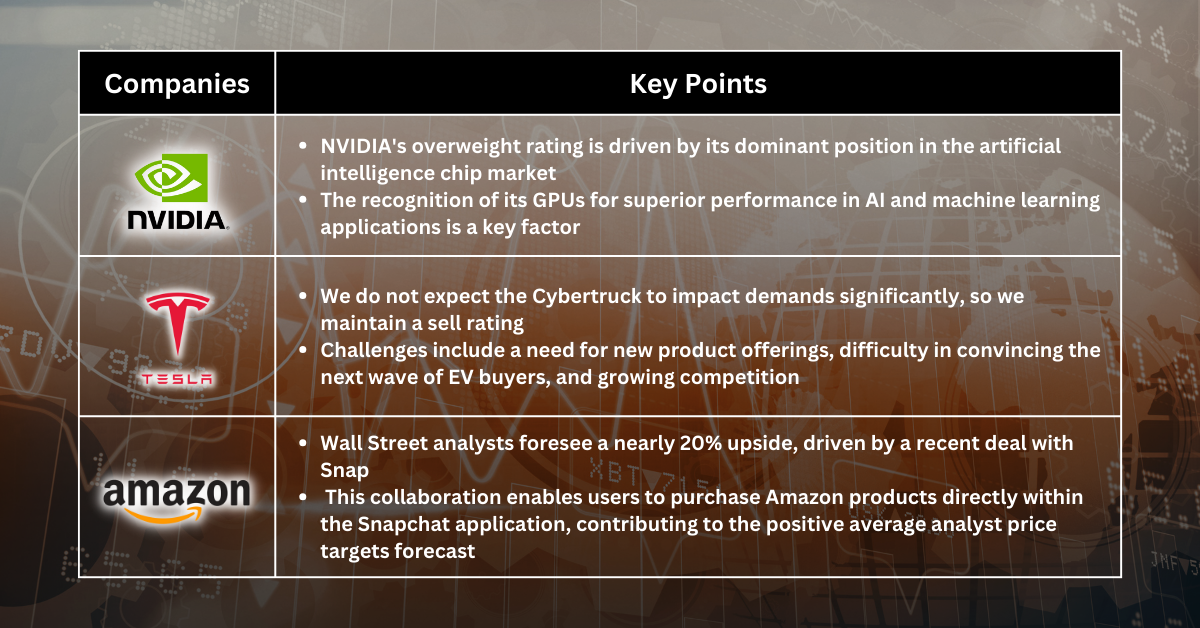

Nvidia Earnings, FOMC Minutes To Provide Further Insights into the Sustainability of the Market Rally

- November 20, 2023

- | Fullerton Markets

The upcoming Nvidia earnings report is poised to be a pivotal event, drawing the attention of investors eager to assess the sustainability of the November rally as the year approaches its end.

Stocks Pick of The Week - US Indices Surge Amid Optimism, but Scepticism Lingers

- November 20, 2023

- | Fullerton Research

Major US stock indices are poised for their third consecutive week of gains, with the S&P 500 and Nasdaq registering over 2% increases by Thursday's close, and the Dow expected to climb by 1.9%.

US Inflation Figures - A Litmus Test for Market Resilience

- November 13, 2023

- | Fullerton Markets

The strong start to November undergoes a crucial assessment this week as market participants analyse October's inflation data. This information is pivotal for gaining insight into the Federal...

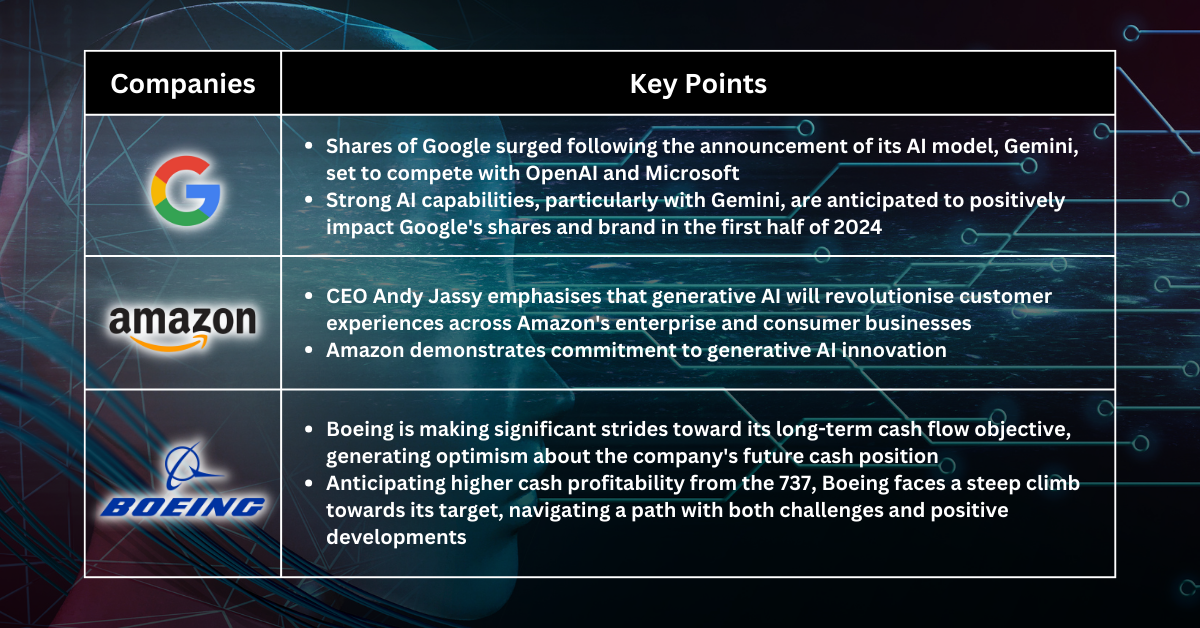

Stocks Pick of The Week - Powell’s Warning On More Rate Hikes Suggests Consideration of Non-Tech Stocks For Now

- November 13, 2023

- | Fullerton Research

Consensus widely expects Fed cuts and solid consumer spending to allow the U.S. economy to glide down for a soft landing. However, Fed Chairman Jerome Powell said Thursday that policymakers are...

Stocks Pick of The Week - Powell’s Warning On More Rate Hikes Suggests Consideration of Non-Tech Stocks For Now (Clone)

- November 13, 2023

- | Fullerton Research

Consensus widely expects Fed cuts and solid consumer spending to allow the U.S. economy to glide down for a soft landing. However, Fed Chairman Jerome Powell said Thursday that policymakers are...

Traders Engage in Active Purchasing Across Markets, From Equities to Fixed Income

- November 6, 2023

- | Fullerton Markets

The October labour market report, revealing signs of a decelerating labour sector, carries potential to impact the Federal Reserve's stance on monetary policy. The recent data release is amplifying...

Stocks Pick of The Week - Tech Stocks Present Attractive Opportunity as Fed Signals End to Rate Hikes

- November 6, 2023

- | Fullerton Research

In the wake of the Federal Reserve's recent decision to maintain interest rates, the stock market has exhibited significant bullish momentum. This comes as the Fed not only kept rates unchanged but...

Fed, NFP, and Apple Earnings May Not Be Friendly to The Entire Financial Market

- October 30, 2023

- | Fullerton Markets

The financial world is poised for a pivotal week, with three significant events on the horizon that could have far-reaching implications for investors. The FOMC meeting and the release of the October...

Stocks Pick of The Week - Nasdaq Moves Into Correction Territory; Bear Market Could Be Coming

- October 30, 2023

- | Fullerton Research

The Nasdaq Composite dropped deeper into correction territory on Thursday after many large tech firms did not quite live up to investors’ expectations.

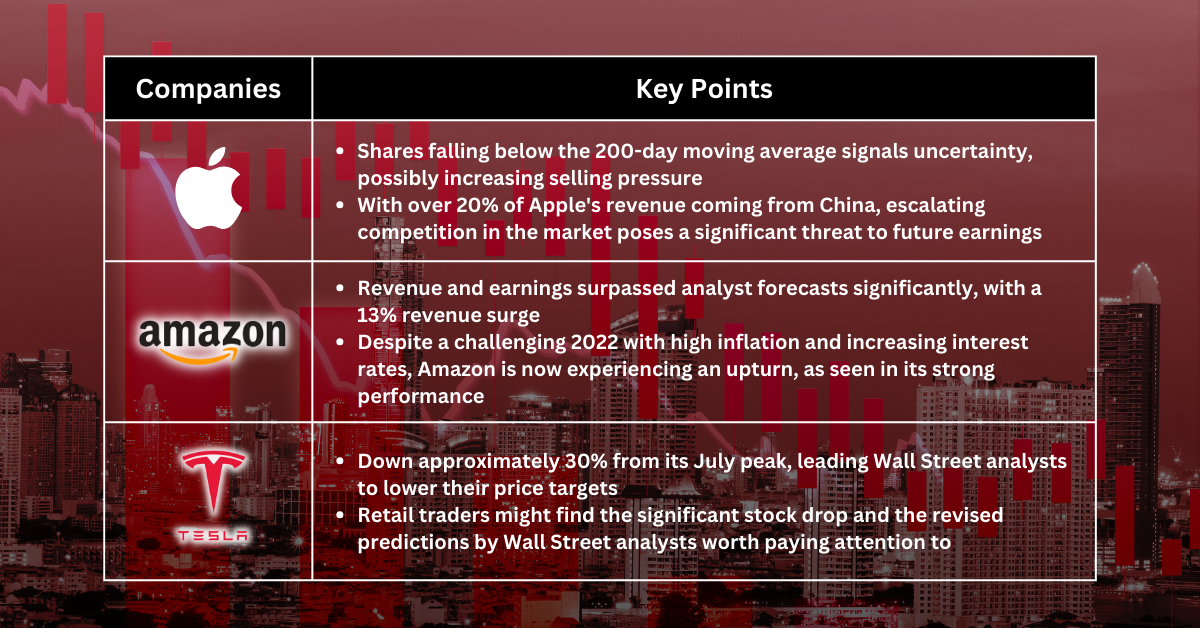

Tech Giants' Earnings Season Looms, A Portfolio Shift from FX to Stocks

- October 23, 2023

- | Fullerton Markets

The investing landscape is gearing up for an eventful week as earnings season unfolds, with a striking 30% of S&P 500 companies poised to unveil their financial results.